Governor Walz Gets Federal Funding For Minnesota Businesses Impacted By Warm Winter

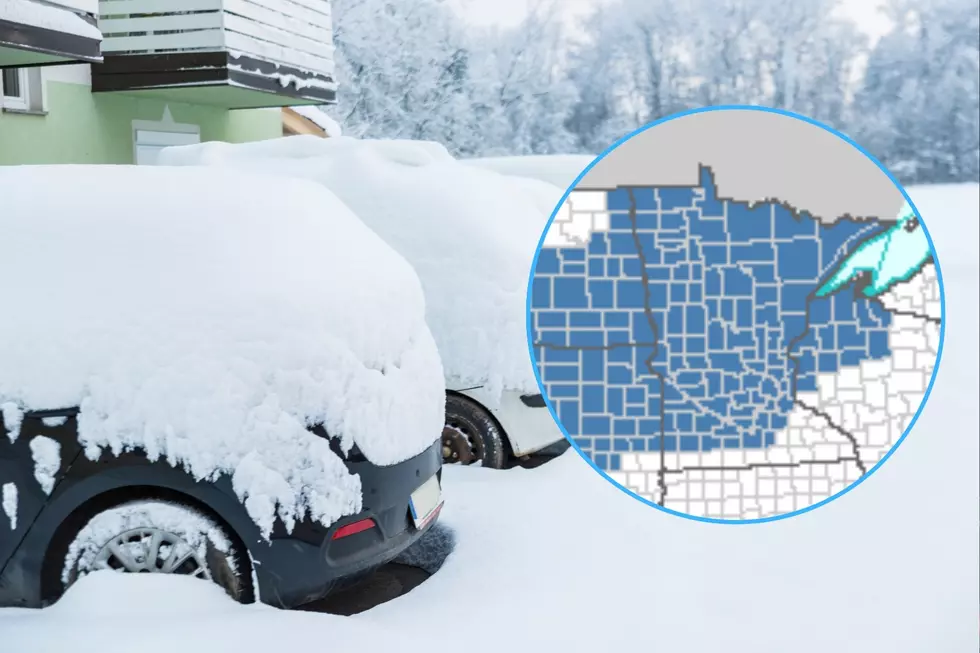

It is a secret to nobody that the winter of 2023-2024 has been exceedingly abnormal in Minnesota. Historically low snowfall and warm temperatures have combined to create significant challenges for businesses that rely on winter tourism money.

Many Minnesotans have taken this winter in stride, sharing a level of thanks for the less expensive heating bills, limited need for shoveling and snow blowing, and smaller numbers of aggressive new potholes. While many have appreciated elements of a "winter off" after last year's record-breaking snowfall, it isn't all good news.

Whether it be bars and restaurants that normally see snowmobile traffic or resorts and other businesses in small-town Minnesota that rely on winter activities and visitors, a large number of businesses across the state have seen serious negative impacts from this winter's weather.

Governor Walz announces financial help for Minnesota businesses

In an attempt to offer relief to these hard-hit businesses that have seen their normal winter cash flow dwindle, Minnesota Governor Tim Walz shared on Thursday that he is getting some help from the federal government for small businesses hit by this winter.

Governor Walz tweeted on Thursday that he and his administration have "unlocked federal assistance" for small businesses that have seen detrimental impacts from this abnormal winter.

As noted in the Governor's message, he is encouraging businesses to apply as soon as possible.

READ MORE: What are the least snowy winters ever recorded?

How does this aid program work?

The aid being offered to Minnesota businesses is coming in the form of loans from the Small Business Administration's disaster assistance program. These Federal Economic Injury Disaster Loans are being made available, according to KBJR, due to the "ongoing federal drought declarations" that are impacting 81 of Minnesota's 87 counties.

Small businesses impacted by these conditions in the affected counties can apply for a loan up to $2 million to cover the losses realized. Businesses receiving these loans pay no interest for the first year, and are subject to an interest rate no higher than 4% after that for the remainder of the duration of the loan payback period.

Businesses can apply via the SBA link shared by Governor Walz in his message on X, which can be found here. In addition, businesses can also contact Minnesota’s Small Business Development Centers and SBA’s Customer Service Center by calling 800-659-2955 or emailing the SBA office.

The 15 Least Snowy Winters On Record In Duluth History

Gallery Credit: Nick Cooper - TSM Duluth

More From MIX 108